Table of Contents

Year End Closeout

There is a video tutorial walking through fiscal year end on the PINES Learning Center.

What is Year End?

Year End closeout is the method that Acquisitions uses to close out one fiscal year and begin another.

What happens in year end?

- For funds marked propagate, a new fund with the same parameters (code, name, etc) is created in the new fiscal year

- For funds marked rollover, with the intent to–

- Rollover encumbrances only - Any unspent money in the fund is NOT rolled into the next year’s fund; it is deallocated back to its originating funding source. Existing fund debits in the fund are transferred to the next year’s fund, and the funds used in affected line item details will be updated to the new year's fund

- Rollover encumbrances and money - Any unspent money in the fund is rolled into the next year’s fund, existing fund debits are transferred into the next year’s fund, and the funds used in affected line item details will be updated to the new year's fund

- For funds not marked rollover, any unspent money in the fund is deallocated back to its originating funding source

- Old year funds are marked as inactive so new debits can’t be charged to it

How to prepare for year end

Preparing for year-end mainly involves cleaning up your acquisitions activities over the past year and tying up any loose ends. This is mainly done through running a series of reports to give you a snapshot on the status of your acquisitions.

Acquisitions freeze

In terms of acquisitions, “freeze” generally refers to making purchases. So this would mean halting purchasing for the length of the freeze, not stopping marking items received or closing invoices.

Whether or not to establish an acquisitions freeze is a local decision. There are several reasons why you may want to institute an acquisitions freeze, whether it’s for a month or a week.

Why might you want to establish a longer acquisitions freeze?

- Allows on-order items to arrive, be received and invoiced

- The more items that are received and invoiced before running your reports, the shorter your reports (and the information you’ll need to look through) will be

Canceling backorders

Whether or not to cancel backorders is a local decision, but that decision must consider the way that funds are set up.

If you have purchase orders in your current fiscal year where you would like the backorders to carry into the next fiscal year, the following settings are required:

- Funds must be marked marked “rollover”

- Must follow closeout instructions for “Rollover encumbrances only” or “Rollover encumbrances and money”

If you will not be rolling your money forward, or just do not wish to carry backorders into the next fiscal year, you will need to cancel those line items in Acq before doing your fiscal year end. To do this:

- Contact your vendors first, and obtain a list of any items that are still outstanding

- Decide if all of these items are to be cancelled

- Let the vendor know which items should be cancelled, and get confirmation that they are indeed cancelled

- Use the Line Item Search to cancel these items in Acquisitions

Reports

There are several reports to run, and there is a somewhat logical order to run the reports in. You may wish to follow the workflow proscribed here. All reports are located in Reports→Shared Templates→PINESacqadmin→Year End Reports.

You will want to run these reports once your freeze has started–possibly a month or more before year end–to assess your current status and what needs to be resolved. Then you will want to run these reports again just a few days to a week prior to closeout, to clean up any remaining issues.

1. Report: “List of funds with parameters”

This report is to aggregate all the parameters of each of your funds for you to confirm that they have the appropriate settings before closeout

| Done | Action |

|---|---|

| Confirm that all the funds you wish to be propagated in the new year have Propagate=True | |

| Confirm that only the funds you wish money and/or encumbrances to rollover have Rollover=True | |

| Any fund marked Rollover=True must also be marked Propagate=True |

2. Report: “Copies that are still outstanding (on-order or backordered)“

The goal after cleaning up with this report is that all line items will be either received or cancelled. If encumbrances are carried forward, “on-order” or “backordered” are also acceptable.

| Done | Action |

|---|---|

| Verify using packing slips if items were physically received | |

| If they were, mark items received in Acquisitions | |

| If not received, check if items were backordered/cancelled by the vendor. If so, mark backordered/cancelled in Acquisitions | |

| If choosing to cancel backorders, you may wish to cancel with vendors at this point and mark items as Cancelled in Acquisitions | |

| Before canceling, check if it's being processed or is en route to you. If so, don't cancel the items. | |

| If not cancelling backorders, confirm that these items are billed out to funds marked Rollover=True |

3. Report: “Purchase orders with pending or on-order status”

| Done | Action |

|---|---|

| If there are any purchase orders that are in pending status that you wish to order, they should be activated | |

| If there are POs that you did not want to order (errors, POs with all line items deleted, etc), you may want to change the PO names to designate that they are not real orders (e.g. DELETE-Mayordererror) | |

| Most of the on-order POs should have been cleaned up by the previous report (Line items not received), so you may want to investigate any remaining POs with a status of “on-order” |

4. Report: “Paid invoices with unreceived items”

This report is to isolate any items that were paid on invoices but that you never received them. If, after running the previous reports and then this one, you find that indeed there are items that you did not receive from the vendor but you paid their invoice, you may want to reach out to the vendor for a refund.

| Done | Action |

|---|---|

| Confirm from the vendor how many copies were shipped | |

| Check which branches were ordered for, and see if those branches have cataloged copies | |

| Mark copies as received in Acq | |

| (Optional) Contact vendor for resolution (replacement or refund) on any items not found |

5. Report: “List of invoices that are not closed”

| Done | Action |

|---|---|

| Confirm if invoices have already been sent to Accounting for payment | |

| If so, mark invoices as closed | |

| If invoices have not been sent, close and send for payment |

6. Report: “Fund summary”

If you have funds that rollover money and/or encumbrances, you may wish to run this report immediately prior to doing your dry run closeout. That way when you view the dry run of the new created funds you can spot-check that the numbers are correct, and once you do the final closeout you can compare against the money and/or encumbrances that were moved between fund years.

Year End Closeout

After you have done your prep work of running reports and cleaning up your data, you should be ready to complete your year end closeout.

Updated 6/10/2022

1. Open a Helpdesk ticket at https://help.georgialibraries.org.

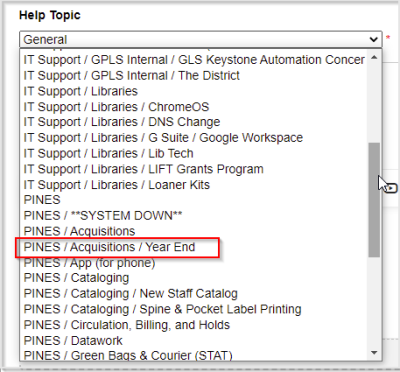

2. For the Topic, choose PINES /Acquisitions /Year End.

3. Fill out information in the Issue Summary and Details fields, then fill out the form below.

4. Confirm what type of rollover your library does.

5. Indicate if you would like PINES staff to deactivate the closing year's funding sources for you. If there are any funding sources that should not be deactivated, please write their name or code in the box below it.

6. Indicate you understand that you will be provided with a spreadsheet to confirm that the projected outcome of closeout matches your expectations, and that once you approve the spreadsheet that PINES staff will be closing out your year on your behalf.

7. If there is anyone else in your system who needs to be kept aware of any issues with closeout (like things to be remedied before closeout, spreadsheet review, etc), please list their name in the last box. PINES staff will add them to the ticket.

8. Click Create Ticket.

9. PINES staff will review your reports to ensure that there are no lingering issues. If there are any issues to be cleaned up before closeout can be performed, they will contact you via the ticket, which will come to your email.

10. Once any issues are resolved, PINES staff will provide you with a spreadsheet with the anticipated outcome of closeout.

11. Once PINES staff receives your approval, closeout will be performed and you can move forward with starting your new fiscal year.

Starting the new fiscal year

Once you have done your closeout, you are officially into your new fiscal year in Evergreen. There are only a few more tasks to finish up closeout and beginning your new year.

- Create new funding sources for the new fiscal year

- Lift the Acquisitions freeze